France is on the brink of significant e-invoicing reforms, with mandatory electronic invoice receipt and issuance phases rolling out in 2026 and 2027, respectively.

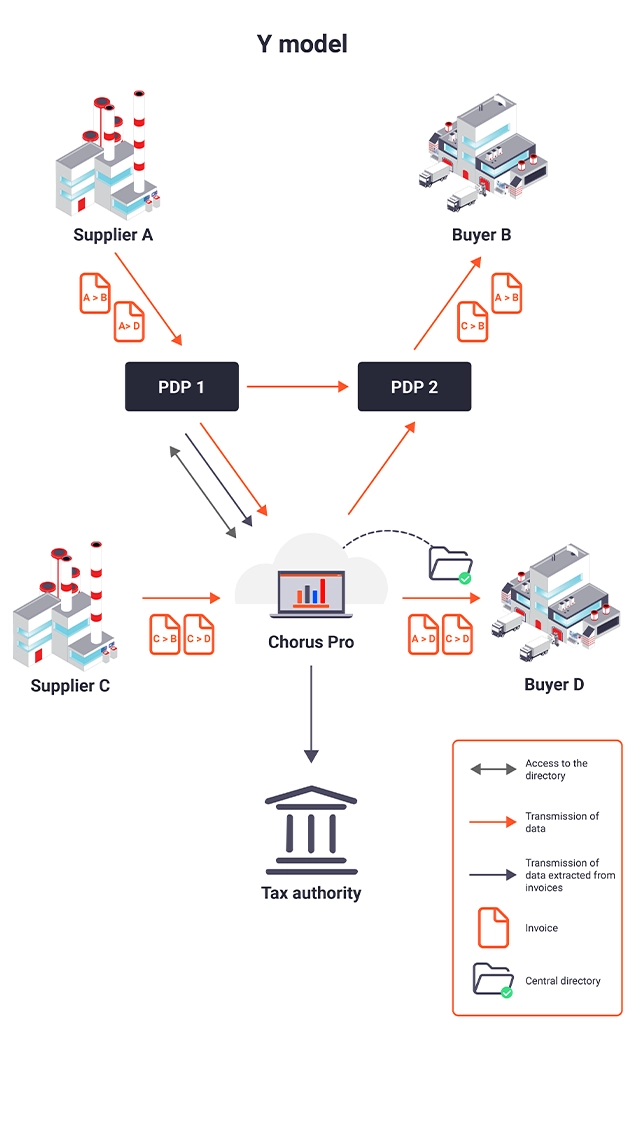

Exchanging e-invoices directly between trading parties will not be allowed. Either registered service providers (PDP) or the centralized governmental platform Chorus Pro will be allowed to transmit the e-invoice to the buyer party.

Subsequently, one significant change for most tax paying businesses will be the need to choose a Partner Dematerialization Platform, also known as PDP, for all incoming and outgoing invoices.

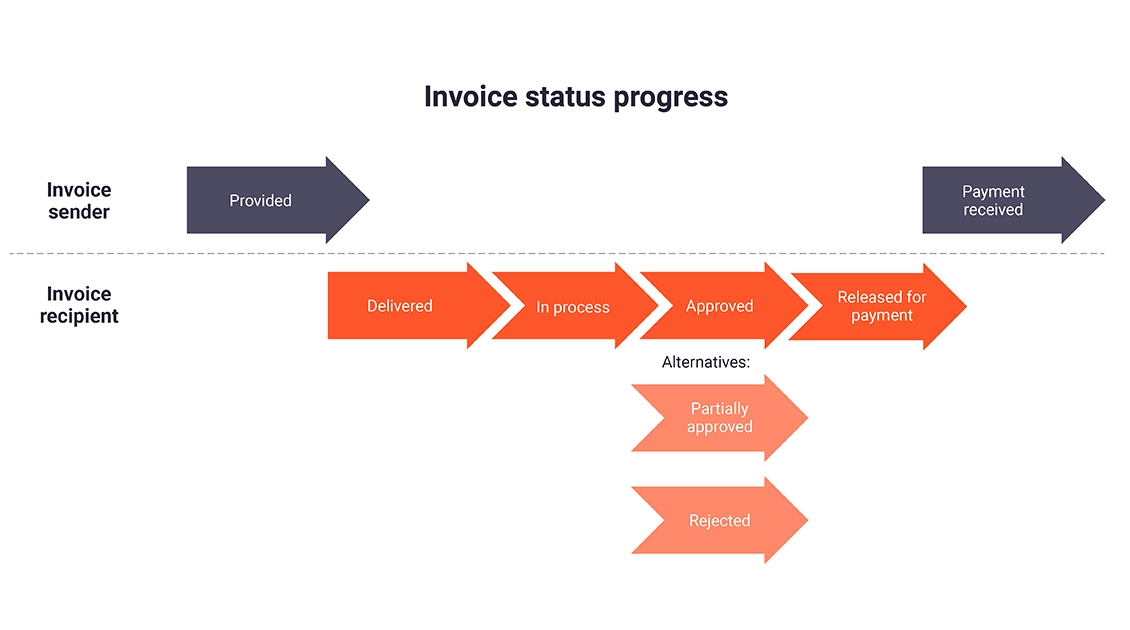

Under the mandate, the role of a PDP is highly specialized. Not only the registered service provider enables the business to comply with strict legal and technical requirements, but the PDP also makes sure mandatory payment status data for each invoice is exchanged with Chorus Pro and the other connected PDPs.

In addition, PDP can offer optional added-value services such as message conversions from/to existing formats, pre-validation, reporting functionalities, interfaces to ERP system etc. In September 2026, all companies must be able to receive e-invoices under the new rules. Large and medium-sized companies will have to issue invoices following the new mandate. Starting from September 2027 obligations will apply to small companies as well.

Companies that don’t follow France’ stringent e-invoicing requirements will face substantial fines.

Businesses should start preparing for the e-invoicing mandate well in advance to ensure a smooth transition. Depending on the invoice process today, this involves upgrading accounting and invoicing software, switching from paper invoice to electronic invoice process, switching from PDF to a structured data format and last but not least choosing the right PDP.

Why choosing TecAlliance as PDP:

- Tax compliant electronic invoicing on international level, not only in France

France is not the first and not the last country to introduce CTC (continuous transaction controls). With Mexico, Italy and Poland (coming up) the international fiscal invoicing becomes more complex. TecAlliance has a proven track record in CTC processes, offers a compliant solution for both the French market and for cross border operations. - Use our Order 2 Invoice 2 Returns process on an international level

E-Invoicing is fully integrated into the TecCom Suite. That means additionally, to compliant electronic invoicing, you can choose to exchange article and price data with your business partners, optimize stocks through order proposals, order and track the order fulfillment as well as manage the reverse logistics. All of that, fully automated and even integrated into your ERP system. - A solution specifically designed for the IAM processes

Our solution best fits IAM business. Top notch data quality due to fulfillment of Independent Aftermarket industry standards allows you to minimize errors and reduce manual work to the minimum throughout your order to invoice processes. TecAlliance e-Invoicing is fully compatible with established IAM standards (tXML2.5 and EDIFACT D96.A GOLDA).

Do you need more information? Get in touch with our local expert Xavier Thiberge sales.teccom@tecalliance.net.